Help to buy calculator how much can i borrow

Unlike a residential mortgage where the amount you can borrow is based on your salary and your outgoings a Buy to Let mortgage is assessed on the rental income that the property is likely to generate. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on.

5 Best Mortgage Calculators How Much House Can You Afford

This may influence which products we write about and where and how the product appears on a page.

. A help to buy mortgage calculator tells you how much youll need to borrow if you take out this government scheme. See the example below. This will give you a solid idea of how much you.

Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is how much you have saved for a down payment and what your monthly debts or spending looks like. Because almost all buy-to-let lenders need a deposit of 20 from you this calculator caps the amount you can borrow at 80 of the property value. Regional price caps are in place limiting the maximum cost of homes sold under the scheme.

Use this mortgage calculator to estimate how much house you can afford. With a Help to Buy equity loan you can borrow up to 20 of the value of the property which means that you could buy a home with just a 5 deposit and a mortgage for the remaining 75. While your personal savings goals or spending habits can impact your.

2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. Or 4 times your joint income if youre applying for a mortgage. Find out what you can borrow.

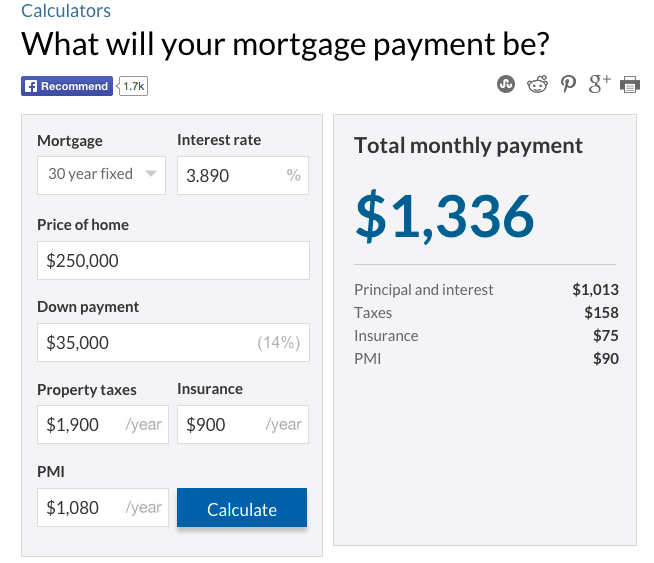

You can borrow 20 of the purchase price 40 in London interest-free for five years. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford.

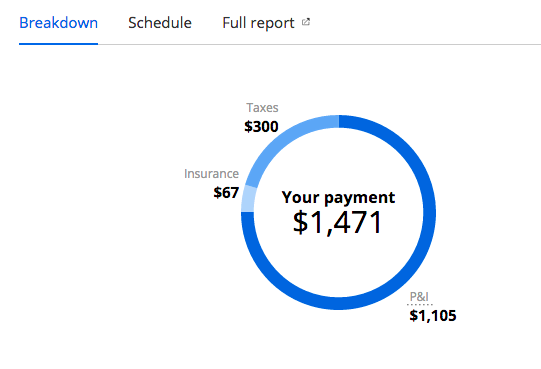

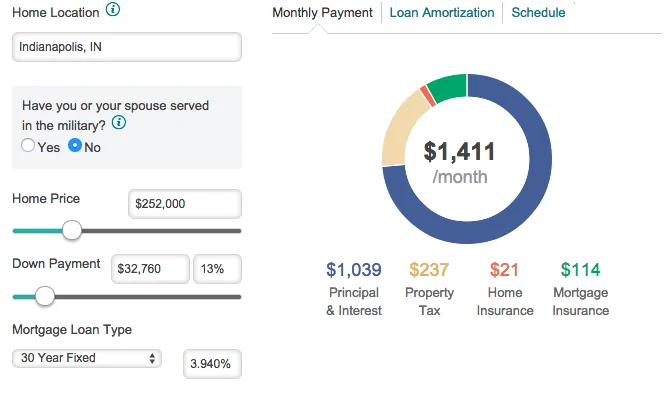

Youll need to put in your deposit the purchase price and whether you live in England Wales or Scotland. See your total mortgage payment including taxes insurance and PMI. How much can you borrow.

This could also help you to decide what type of property you can afford to buy and where. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Itll then tell you what your Help to Buy loan would be as well as your remaining mortgage.

A mortgage broker can save you from making a big mistake. Our buy to let mortgage calculator gives you essential information on interest rates LTV monthly payments how much you can borrow and more. You might be able to borrow more than it shows you.

When it comes to calculating affordability your income debts and down payment are primary factors. You can also input your spouses income if you intend to obtain a joint application for the mortgage. Your salary will have a big impact on the amount you can borrow for a mortgage.

This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. According to 2020 figures from the Ministry of Housing Communities and Local Government four fifths of the 291903 properties bought via the scheme were by. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator.

Brokers can help you avoid pitfalls because they know the mortgage industry the differences among lenders and the twists and turns in the. Lets presume you and your spouse have a combined total annual salary of 102200. Simply enter the amount you wish to borrow the length of your intended loan vehicle type and interest rate.

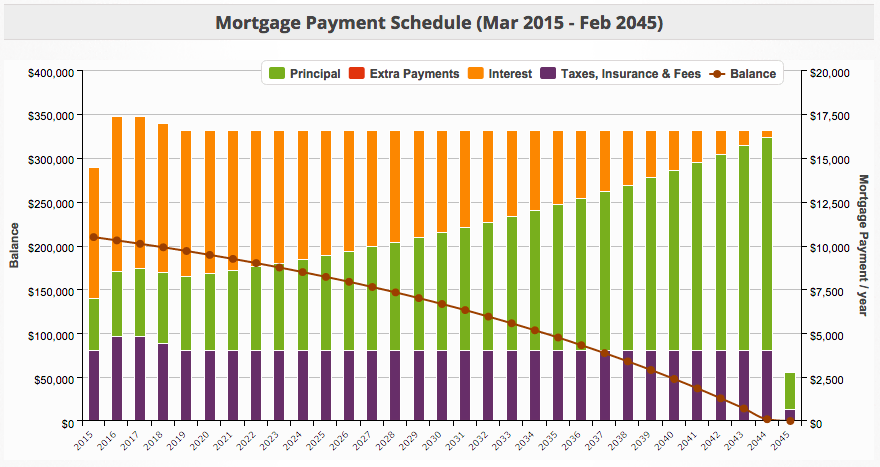

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. Lenders will typically need the rental income to be at least 125 of the monthly mortgage payments on an interest only basis or even up to. If you already have a household budget sorted know how much you can spend each month on a mortgage and know how much you want to borrow this calculator could help you decide what loan conditions might suit your circumstances.

Increase your property value. This estimate will give you a brief overview of what you can afford when considering buying a house. Help to Buy is a government scheme to help first-time buyers get a property with just a 5 deposit.

If you buy a home for 400000 with 20 down then. Things like your deposit and credit rating will also be factors so remember our calculation is only a rough idea of what you. For this reason our calculator uses your income too.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. We can help you compare products lifetime costs to ensure you secure the most financially efficient option. There are two options on the calculator below.

The size of loan and maximum property price vary according to where youre buying. Usually banks and. Mortgage calculator Find out how much you could borrow.

Create an account and well find out for. Many or all of the products featured here are from our partners who compensate us. How much can I borrow.

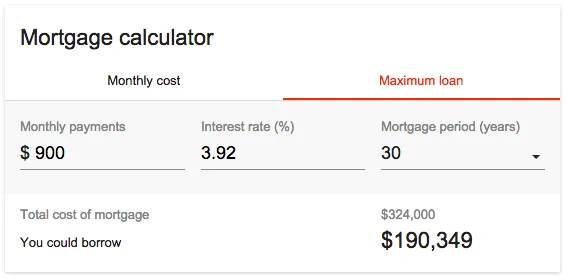

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else.

You can use the above calculator to estimate how much you can borrow based on your salary. Factors that impact affordability. As a hypothetical example.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Help to Buy equity loans enable homebuyers to purchase a new-build property using a government loan. This mortgage calculator will show how much you can afford.

1 Our quick and easy mortgage calculator also displays the amount of cashback 3 you could get when you drawdown your mortgage. Help to Buy is a UK Government initiative to help people buy a new build property. And legal costs alongside the rate.

Use our mortgage repayment calculator to estimate your monthly repayments or calculate how much you can borrow. The calculator will estimate your monthly payment to help you determine how much car. You can apply to the scheme until 31 October 2022.

5 Best Mortgage Calculators How Much House Can You Afford

Plan Your Higher Studies With Education Loan Eligibility Calculator Education Loan Calculator

What Credit Score Is Needed To Buy A House Credit Score Credit Score Repair Improve Credit Score

5 Best Mortgage Calculators How Much House Can You Afford

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Home Affordability Calculator Credit Karma

5 Best Mortgage Calculators How Much House Can You Afford

Can I Afford To Buy A Home Mortgage Affordability Calculator

Loan Affordability Calculator With Up To 8 Midterm Modifications Online Job Opportunities Paying Off Credit Cards Online Jobs

This Easy Loan Calculator Will Help You To Quickly Calculate The Monthly Payment And Total Interest Cost For An Amount Easy Loans Loan Calculator Money Advice

Lvr Calculator Or Loan To Value Ratio Will Work Out The Amount You Borrow It Is The Value Of A Property Used As Security I Lenders Mortgage Mortgage Brokers

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Home Buying

Know The Cost Of Waiting Or In Some Cases The Cost Of Procrastinating Interoolympics Visit Buyo Real Estate Advice Real Estate Infographic Selling Real Estate

Mortgage Calculator How Much Can I Borrow Nerdwallet Mortgage Lenders Best Mortgage Lenders Mortgage

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

5 Best Mortgage Calculators How Much House Can You Afford

Steps To Buying A House Buying First Home Home Buying Tips Home Buying